Being a real estate investor, I have openly said it would be much more difficult to invest in Canada without our immigration policies and openness to allow those from other countries to start a new life here. With 400,000 new people entering Canada yearly (100,000 of which go to Ontario), there is no wonder the demand for places to live. In the GTA alone there is an expected 3.2 million new people expected in the next ten years. With measures already in place to limit available land (ie: Green Belt, Places to Grow Act), the need for homes and housing will continue to grow.

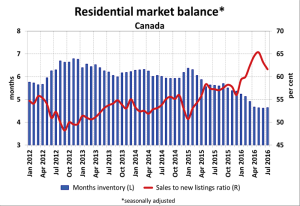

The above chart is one of the truest economic indicators of why home prices continue to increase. We could look to foreign investment, politics, or other places to put blame, however in my humble opinion it comes down to simply supply and demand (of which many factors do have an influence). Typically there is several months of inventory in homes for sale vs the actual sales, and in most cities we have a hot sellers market, meaning bidding wars are common place, and sold prices are well above asking. Since early 2015 we have seen the inventory of homes on hand shrink in relation to supply, and we also see a much higher percentage of sales vs new homes coming on the market.

We have seen Real Estate prices skyrocket much to high for my comfort level and I fear the current and next generation of adults will find it next to impossible to purchase a new home. With Millennials wanting flexibility and not wanting to be tied down to one place, as well as home affordability being difficult, the rental market will continue to be strong. Tie this into our projected population growth, we see the demand for homes, as well as the demand for affordable homes to rent will continue.

As an investor I have no idea where appreciation will take us, and I usually advise against speculative property investments tied to appreciation. The housing market could correct, or it could continue to rise. However having the ability to purchase an asset that will deliver positive cash flow through renting, as well as a healthy return even without taking any appreciation into account, is a sound investment strategy. It mitigates risk, and opens the door for long term wealth building when you actually do factor in appreciation.

Visit us at www.mkproperties.ca or our page MK Investment Group to learn more about how we invest in real estate, or reach out if you would like to learn how we are providing double digit returns for our partners year over year.

Happy Investing!