This post may not sit well with some as I’m getting into a subject that is not the easiest dinner time conversation – Saving money, and paying off your own home as quick as possible. We as a society have been trained to save money, and pay off our own homes to live debt free. I for one spent the better part of my life in this mindset. Unfortunately, this mindset makes it very difficult for us to build our wealth. The old saying of “a penny saved is a penny earned” has far outlived its impact.

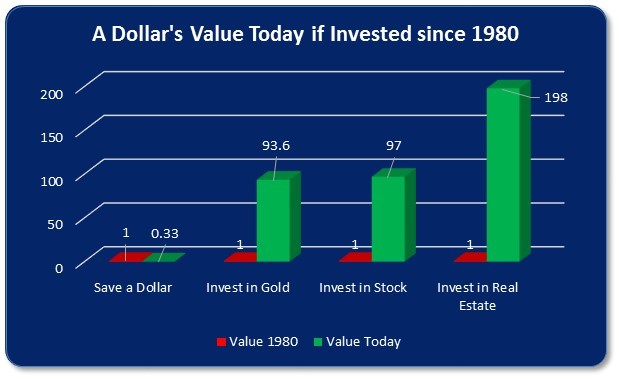

Let’s look at the raw form of saving and for lack of a better term, sticking it in the mattress and “sitting on it”. Simply taking inflation, the longer you hold on to money, the less it will be worth in the long run. For example, since 1980, the buying power of a dollar has eroded by about 67%, or roughly 1.9% each year. So in today’s terms, if you see a nice glossy advertisement from your bank telling you that you can earn 2% interest on your savings, you are essentially barely breaking even.

Now look at the value of assets over the same 36 years. On average, the housing market has gone up 5.5% yearly since 1980, gold has increased 97% over this same timeframe or 3.7% yearly, and the S&P 500 stock market index has averaged 3.6% yearly. Any of these options at least gets you a little ahead of the game. It should be clear that there are better alternatives for the long term, and saving alone does more harm than good.

On to the scary part and talking about your home. Over the years, we strive to pay off our mortgage and eventually get to a point of being mortgage free. Once this happens it is a huge stress relief for many people. Unfortunately, this is only eliminating a monthly expense, but it is not doing anything to build your wealth. The great thing with owning a home is that typically at any point in time the bank will offer you up to 80% of it’s value in the form of an increased mortgage, or a loan (at today’s rates of say 2.5 – 3.5% that is cheap money). The banks understand the risks associated with real estate and are comfortable providing these loans out simply given the historical and projected real estate market, as well as that it will likely not lose its value. Please read our previous blog post “The Truth About Debt – It’s not all bad, and can be quite good!” for more information on the benefit of having “smart” debt.

On to the scary part and talking about your home. Over the years, we strive to pay off our mortgage and eventually get to a point of being mortgage free. Once this happens it is a huge stress relief for many people. Unfortunately, this is only eliminating a monthly expense, but it is not doing anything to build your wealth. The great thing with owning a home is that typically at any point in time the bank will offer you up to 80% of it’s value in the form of an increased mortgage, or a loan (at today’s rates of say 2.5 – 3.5% that is cheap money). The banks understand the risks associated with real estate and are comfortable providing these loans out simply given the historical and projected real estate market, as well as that it will likely not lose its value. Please read our previous blog post “The Truth About Debt – It’s not all bad, and can be quite good!” for more information on the benefit of having “smart” debt.

If you have a home that you bought for say $500,000 and it is now worth $800,000, you would essentially have access to $640,000 available to you if the home is fully paid off (if not then you would have access to $640K less the current mortgage amount). So with all of this money available, if it just stays in the home and sits, it is the same as having it sitting under the mattress and doing nothing, or losing its value over the long term. If you took it out to invest (not to buy a new car or take a vacation J), you would still benefit from the appreciation in your own home year over year, but you would also have the ability to use up to $640K to help you grow your wealth. You can even use it for a 20% down payment on another home, which guess what, the bank will pay up to the other 80% for! This means that you essentially would not have to save for any down payment at all but be able to acquire another home without even going into your own pocket. With this, I simply wanted to illustrate that many of us have much more money at our disposal than we think; how to invest it and the returns you can make is another topic. However, regardless of how you invest, if you have access to funds (specially at today’s historically low rates), you are missing a substantial opportunity to build your wealth. I will cover leverage in in my next post and how the 5.5% growth in real estate we talked about earlier could be upwards of a 25% yearly return for your money. Stay Tuned.

Visit us at www.mkproperties.ca and our page MK Investment Group on facebook or LinkedIn to learn more about how we invest in real estate, or contact us if you would like to learn how we are providing double digit returns for our partner’s year over year.

Happy Investing!

Martin Kuev is a full time Real Estate Investor, Realtor and Investment Coach. He has worked for some of the most respected and well-known global organizations including Coca-Cola, Kraft and Nestle. With a multi-million-dollar real estate portfolio and team he built over the past decade, he left the corporate world to have the flexibility to spend time with his family (including 3 young girls), continue with his real estate investments and help others build their long term wealth.