Hello Everyone, welcome to cold & flu season! It seems like many people we know have caught some sort of bug. With three young children, 2 of which started daycare late last year, we are no different. The last two months has hit us with strep throat, fevers, sinus Infections, the flu…you name it. Tis the season, and all we can do is keep our head up and keep moving forward. Getting sick and real estate go hand in hand; unexpected things can hit you and stop you in your tracks. I’ve had floods, leaks, furnace issues, and much more, all happen at not so good times. When these things happen we just need to deal with them and keep moving forward (or better yet, outsource those things so they are not a burden to you living your life).

Hello Everyone, welcome to cold & flu season! It seems like many people we know have caught some sort of bug. With three young children, 2 of which started daycare late last year, we are no different. The last two months has hit us with strep throat, fevers, sinus Infections, the flu…you name it. Tis the season, and all we can do is keep our head up and keep moving forward. Getting sick and real estate go hand in hand; unexpected things can hit you and stop you in your tracks. I’ve had floods, leaks, furnace issues, and much more, all happen at not so good times. When these things happen we just need to deal with them and keep moving forward (or better yet, outsource those things so they are not a burden to you living your life).

2017 has been quite busy for myself and for MK Properties. With a new year, there is a surge of investors getting into the market as they do not want to miss out to invest while they can still find cash flowing properties. We have purchased nearly 20 new investment properties for our partners and clients in just the first several weeks of the year. We have also had the opportunity to share much of our knowledge with others over the last several weeks. We started our Vaughan Real Estate Investors Meetup, and I have started teaching a class at Rock Star Real Estate focusing on adding a legal second suite to investment properties. Also, on February 4th, I had the opportunity to speak to almost 700 active investors at the “Your Life. Your Terms” event on increasing cash flow and equity with secondary suites. The picture above is of me on stage at the event. It has been a great start to the year, and we look forward to continuing the momentum.

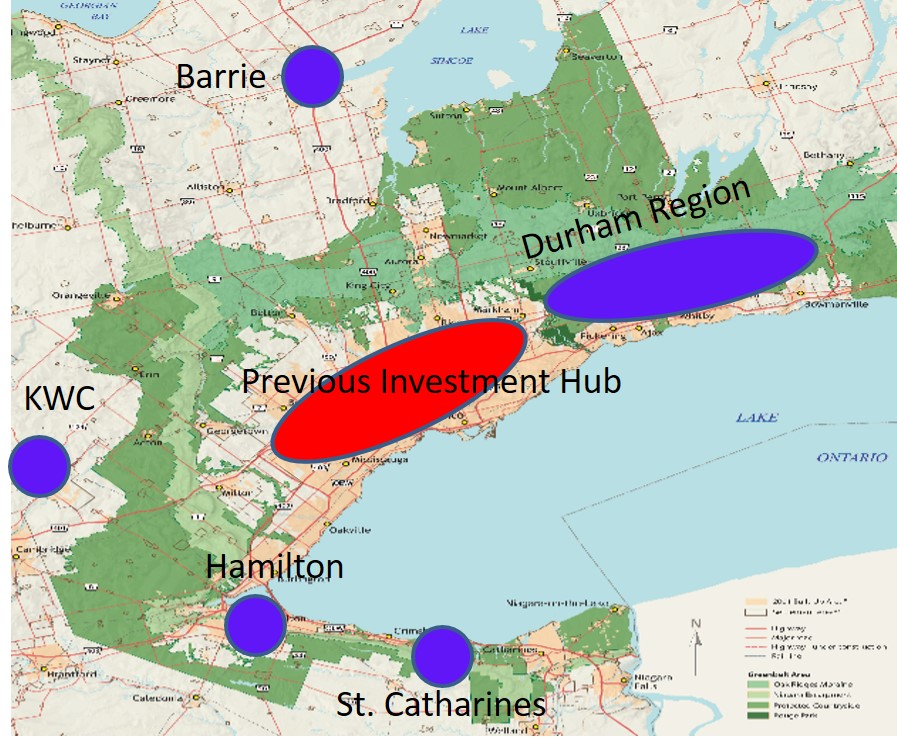

To be a true investor, you need to know your key investment markets intimately, and also have a pulse on other markets (one good reason is you never know when you can be priced out of your own market and forced to move to others). We typically invest in Ontario’s golden Horseshoe. This unfortunately does not include places like Toronto, Mississauga, Burlington, Oakville, Vaughan, or likely anything in the GTA (Greater Toronto Area). Once upon a time you could find properties that cash flowed in these areas, making them sound investments, unfortunately in today’s market you will be hard pressed to find an investment in the GTA that is not dependent on appreciation for you to profit. Check out our previous blog “Do your investments profit even when the market corrects itself?” where we explain how to invest without relying on appreciation to profit.

As each of these cities were great investment opportunities many years ago, today our key markets are all outside the GTA. They include Hamilton (and the Niagara corridor), Barrie, Durham region, and Kitchener/Cambridge. As an active investor and Realtor, I for one think the days are numbered for these cities to be able to find cash flowing properties. This will likely push us even farther outside of the GTA. The reason for this is that for all our lifetimes (and likely our parents’ lifetime), the housing market has increased at a much faster rate than the rental market. So why has the Golden Horseshoe been a hot real estate market for decades? (and in my opinion, will continue to be hot)

See the attached map of the Golden Horseshoe. There are several Indicators of this region between the Greenbelt and Lake Ontario that we see as fueling long term demand for housing and thus allowing Real Estate Investors to continue to profit (until it will inevitably become too expensive to purchase for many to live in, and also too expensive to provide significant returns for investors without relying on appreciation). Below are just several of the reasons we think the Golden Horseshoe will continue to grow for years to come.

- IMMIGRATION: Canada has an immigration rate that doubles that of the United States per capita. We have nearly 400,000 people come to Canada each year and 25% of our population choose to live in the Golden Horseshoe. The immigration rate is also not decreasing but rather increasing. This indicator alone has a significant impact on our projections that the demand for housing will likely not decrease (the question is will there be enough supply)

- TRANSPORTATION: Just Google GO transit and you will see the investment municipalities and the province are putting behind transportation. 8 new Go Stations in total, 4 along the Niagara region connecting Niagara Falls to Hamilton, and then another 4 in Durham Region Stretching out to Clarington. All of this within the next 10 years. This initiative makes the major business hub of Toronto very accessible to those living outside the GTA

- LAND SCARCITY: With a lake on one side, and Green Belt on the other, there is not an infinite amount of land to develop. 25% of our population choose to live in this pocket of land; as immigration continues and land becomes even more scarce, who do you think will benefit in the long run? (our bet is on those that own land and/or property in this region).

- GOVERNMENT CONTROLS: The Green Belt is just under 2 million acres of land, and the Government has no plans to allow development. Typically, metropolitan areas want density (ie: building up), rather than urban sprawl (building out). We also have what is called the “Places to Grow Act”, this allows the Government to designate certain regions as growth, and strategically plan for development, which can obviously limit land development.

- CITY PLANNING: Google the Official Plan of any of the cities within the Golden Horseshoe, and you will quickly realize the $billions that are being spent on transportation and infrastructure. This is all in preparation of the onslaught of immigration we will get over at least the next two decades.

- THE WORLD LOVES CANADA: I have had the privilege of living and working on several continents. The common theme I have seen from my personal experience is that everyone loves Canadians. This is not just my opinion; the internet has a mass of information to support this. It’s no wonder many travelers from the USA sew a Canadian flag on their backpack. Canada is also consistently among the top 3 best places to live on earth year-in year-out. It speaks for itself that our quality of life is desired by many that do not live here (ie: just look at the foreign investment that continues to come into Canadian Housing).

We are not economists, or planners, but just simple real estate investors. We analyze the numbers, to ensure our financials work on the investment properties we purchase, and then (through factual economic data) ensure those properties are located in areas that are poised for future growth. This is only the way we see things and we always encourage any of our partners and clients to not blindly trust what we say, but rather validate our assumptions. Check out our past blog “Are you asking your financial advisor these questions?” as we openly discuss that we encourage anyone investing their hard-earned dollars should not blindly trust those they get investment advice from, but rather ask how is the person compensated, and also look to validate assumptions, otherwise you maybe only investing based on opinion rather than facts.

Visit us at www.mkproperties.ca and our page MK Investment Group on facebook or LinkedIn to learn more about how we invest in real estate to profit in both an increasing or decreasing housing market. Or contact us if you would like to learn how we are providing double digit returns for our partner’s and clients year over year.

Until Next Time,

Build Wealth-Live Life

If you live in the GTA, we have started the Vaughan Real Estate Investors Club – a meet up run by investors for investors. If you are just starting out, or a seasoned pro, come out to Learn and Network with others like you. Click the link above to go to our site on meetup.com or visit our page on facebook. We look forward to connecting in person.

Martin Kuev is a full time Real Estate Investor, Realtor and Investment Coach. He has worked for some of the most respected and well-known global organizations including Coca-Cola, Kraft and Nestle. With a multi-million-dollar real estate portfolio and team he built over the past decade, he left the corporate world to have the flexibility to spend time with his family, continue with his real estate investments and help others build their long-term wealth.