- Building Wealth Through Real Estate Investment

- info@mkproperties.ca

Build Your Wealth

"if I had a way of buying a couple hundred thousand single-family homes I would load up on them"

- Warren Buffet

Faq

6 Proven ways Real Estate Builds wealth

We work with partners who are not satisfied with the returns generated through traditional investments such as stocks/ bonds/mutual funds, and are looking for an alternative. Stock market returns are projected to grow roughly 7%/year over the next 10 years*. Although no investment vehicle is 100% guaranteed, our typical returns generated for partners is 12-25%/year, which usually increases the longer an investment property is held. (* source: The Globe & Mail)

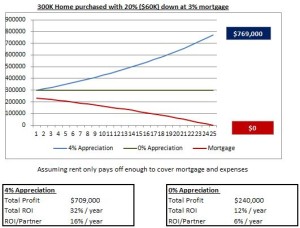

As a property increases in value, wealth is built simply by the time associated with owning the property (assuming the mortgage and expenses are paid). This coupled with a mortgage that is being paid down by tenants allows you to increase your wealth, while decreasing your debt. Even if a property does not appreciate at all, if rent simply covers expenses, there is still a positive return on investment. Lets take a property purchased for $300K today, with 20% down payment, and a 3% mortgage. Lets also assume we rent this property out and only cover our expenses. Then with no appreciation, and only mortgage pay down, the property would yield a 12%/year return on the initial $60K invested. Now lets assume a modest 4% appreciation, in this scenario, the property would yield a total of 32% /year return on investment.

Given the historical appreciation of real estate in Canada (5%+ since 1956), it is one of the most secure investment vehicles available over the long term. Click here to learn how secure real estate investing is.

We only purchase properties that are likely to cash flow well on the positive side. This means that each month we collect rent, after all expenses are paid, there are funds left over for us as the investors to decide what to do with. Given appreciation is a variable in real estate (although a very likely variable), we aim to at least equal, and in most cases beat the average stock market returns by only using Cash flow and Mortgage pay down. Learn more about Our Investment Model.

Leverage alone is one of the most powerful elements of investing in real estate. Let’s say you purchase a $300,000 home. Typically you will only need to supply a down payment of 20% of the purchase price ($60,000). As the property appreciates in value, you are taking advantage of the full $300,000 providing your returns, causing your return on investment to be far greater rate than the property appreciation. Therefore, if the property appreciated 5% in the year, the cash return on investment would be 25%.

Have your largest assets always working for you: In life, we have always been taught to pay down our mortgage and eliminate our debt. However, mortgage is what we call “good debt” given that the asset it is borrowed against typically appreciates over time. As opposed to a car loan, which is a loan on an asset that loses its value over time. One of the great things about owning real estate is that a property owner could withdraw the equity built in a home to do what they want with. They could pay back their initial investment, use it as a down payment on a new property/ investment, or decide what they would like to do with it . This allows an investor to essentially continue to purchase properties, without having to save up for a down payment each time. Essentially, your properties are always working for you. For example, if you own a $300,000 home that appreciates 25% over 5 years, or ($75,000), you have the option to pull out at least $75,000 (as the mortgage has been partially paid down over this time), and decide what you would like to do with these funds. We usually suggest either paying back the initial investment to yourself, or if the funds aren’t needed, reinvesting in additional properties or investments.

Tax Deferred or Tax Free through your RRSP’s or TFSA

Real estate investment is a widely accepted use for RRSP’s, TFSA’s and other savings plans. Most people do not know that you can loan and invest using these funds. In addition to the growth that real estate investment can provide, think of the additional power when your returns are Tax Free or Tax Deferred!

In order for you to use retirement accounts for loans they must first be administered by a third party custodian. One custodian we commonly work with is Olympia Trust Company. You can visit them on the web at www.olympiatrust.com or simply talk to us and we’ll help you with the set up of your account.

Depreciation

In addition to how you invest in real estate, depreciation is also an accounting benefit to investors. By depreciating the value of the home, this reduces or can even eliminate the taxes payable today. This ultimately does get recaptured by the government once the property is sold, however with inflation, the saying is very true that a dollar today is worth far more than a dollar tomorrow (or 10-20 years from now).

By having a tangible investment, we have complete control in how to best utilize our properties. As cities and towns grow and develop, they need to adapt to changes such as population growth and infrastructure. Also, as time passes, tastes change, and homes eventually need updating.

This provides real estate investors with the opportunity to make additions, and/or update their properties, which typically drives up the appreciation, while increasing the return on investment (ROI).

Join Us!

Get Free tips

strategies and other Real Estate Investment information to help build your wealth!

Save your time

Our approach in working with partners takes all the guess work out of real estate investment. It is completely turn key, leaving all day-to-day management to us, and enjoyment of your return on investment to you.

Simple & Secure

Find out how simple it is to invest (in many cases, the funds are already available through the equity in your home). Also learn how secure real estate investment is compared to other investment vehicles.