As we head into the holiday season, and bring and end to 2016, what a year it has been! After starting out the year in the corporate world, with 3 kids under three, barley keeping my head above water, I now enjoy life as a full time real estate investor, realtor, and investment coach…and haven’t looked back since! (I even got to go on my daughter’s field trip a few weeks back which I couldn’t have done while working). I have a lot to be thankful for and look forward to the road ahead. What a great time to also reflect on what the government will give to us in the form of interest rates as well as benefits in our retirement years. Knowing our government, they are quite the giving bunch! Sorry, I couldn’t resist the sarcastic stab, lets get back to real estate investing.

There is no crystal ball in predicting increases and decreases in the Canadian Housing Market. However, the affordability of housing plays a significant factor in the market. Most Canadians do not avoid buying a home worth a million dollars (or more), but focus on what their monthly mortgage payments will be to purchase it. Lower interest rates make it easier for consumers to afford homes, this in part does drive our housing prices up, due to the demand for homes increasing. If we look at our current and previous governments, they have had a deficit budget in place for years, in fact Canada’s national debt is over $600 Billion dollars! What this represents is what the government owes to holders of Canadian Treasury Security. With a deficit budget in place this number climbs each year (it is also what scares me and a lot of people in confidence that things like Old Age Security and Pension Plans will be paid out when people retire – even though we have been paying into those benefits with each paycheck…but that’s another story).

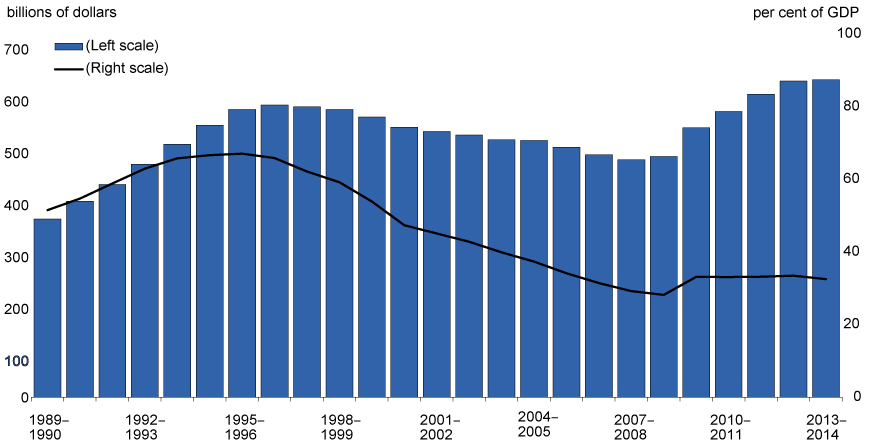

With all this national debt, if Canada raises rates, they are just putting themselves further into the hole. In one of our past posts “The Truth About Debt – It’s not all bad, and can be quite Good” we talk about how using debt, could be one of your best tools to maximize investment returns. However, if that investment return does not service the debt when you need to pay, then it becomes a liability and brings trouble for the investment. See the chart below where it graphs Canada’s National Debt, vs it’s Gross Domestic Product. This alone portrays a picture that the government is not being fiscally responsible with it’s money (or money it doesn’t have!), and it is putting future generations at risk if they cannot pay their debts. We have already read in the news not to expect rates to rise significantly at least for the next 3 years, I for one think it may be longer with the current government in place. So assuming interest rates remain low, and people continue to get mortgages, then housing demand should continue.

We must also look at the other side of the Demand/Supply equation. The supply of Homes in Southern Ontario is just not meeting the demand. Low rates play a role in affordability, however we have approximately 100,000 people entering Ontario each year (and the government is not decreasing immigration, but increasing it). These new entrants coming into Ontario need a place to live. The GTA has water on one side of us (Lake Ontario), and the Green Belt on the other, this makes the current and future value of land south of the greenbelt very lucrative in years to come as it is becoming scarce. Given Toronto is becoming unaffordable, many are forced to go outside of the GTA. Just google the GO train expansion in Durham Region and the Niagara Region (8 new stations by the mid 2020’s) to see the billions of dollars that are being spent on transportation to accommodate the population growth. (HINT: the larger opportunity is likely outside of the GTA in real estate investment)

With the demand continuing, and the supply remaining limited. This will likely continue to drive housing prices up, or at least maintain historical Real Estate growth of roughly +5%. Assuming we accept appreciation will come in some form in future years, the real opportunity today is that money and debt is “almost” free. We can still find cash flowing properties that provide a month-in and month-out return that could mitigate market fluctuation risk, then knowing that even though real estate cycles happen, there will be a point where appreciation will continue and provide the long-term wealth we are looking for.

Visit us at www.mkproperties.ca and our page MK Investment Group on facebook or LinkedIn to learn more about how we invest in real estate to profit in both an increasing or decreasing housing market. Or contact us if you would like to learn how we are providing double digit returns for our partner’s and clients year over year.

Have a Safe and Happy Holiday season!

Happy Investing!

If you live in the GTA, we have started the Vaughan Real Estate Investors Club – a meet up run by investors for investors. If you are just starting out, or a seasoned pro, come out to Learn and Network with others like you. Click the link above to go to our site on meetup.com or visit our page on facebook. We look forward to connecting in person.

Martin Kuev is a full time Real Estate Investor, Realtor and Investment Coach. He has worked for some of the most respected and well-known global organizations including Coca-Cola, Kraft and Nestle. With a multi-million-dollar real estate portfolio and team he built over the past decade, he left the corporate world to have the flexibility to spend time with his family, continue with his real estate investments and help others build their long-term wealth.