Since starting this blog in 2016, most of you have heard about economics, the fundamentals of Real Estate Investment, information to help with mind-set when starting something new, and a little about me and my family. The purpose of this blog is to provide value added information as you consider Real Estate Investment, rather than try to sell you anything. As I became an active investor, I was shocked to realize that only approx. 6% of the Canadian population invest in Real Estate beyond their principle residence. I often cringe when I see advertising dollars at work offering +2% interest on a savings account, and cringe even more when many people actually take advantage of the offer and believe saving will help them get ahead. It is projected that average stock market returns should be about +7% annually for the next decade. Where the average return on Real Estate investment is typically +12% to 30%+ annually (depending how much of the work you outsource or do on your own). The main questions I get when I make statements like this are around risk, which can be calculated and mitigated to protect the investment dollars at work. Check out our previous post “How do you Manage Fear vs. Risk with Your Investments?”

Since starting this blog in 2016, most of you have heard about economics, the fundamentals of Real Estate Investment, information to help with mind-set when starting something new, and a little about me and my family. The purpose of this blog is to provide value added information as you consider Real Estate Investment, rather than try to sell you anything. As I became an active investor, I was shocked to realize that only approx. 6% of the Canadian population invest in Real Estate beyond their principle residence. I often cringe when I see advertising dollars at work offering +2% interest on a savings account, and cringe even more when many people actually take advantage of the offer and believe saving will help them get ahead. It is projected that average stock market returns should be about +7% annually for the next decade. Where the average return on Real Estate investment is typically +12% to 30%+ annually (depending how much of the work you outsource or do on your own). The main questions I get when I make statements like this are around risk, which can be calculated and mitigated to protect the investment dollars at work. Check out our previous post “How do you Manage Fear vs. Risk with Your Investments?”

Many of you have asked what it is I actually do. Firstly, rather than saying “I”, Real Estate is very much a team sport and I would not be where I am today with a strong team around me. Lawyers, Accountants, Property Managers, Contractors, Agents, Other investors, Partners, Mortgage brokers, lenders, etc. Without these strong relationships, it would be difficult to excel in Real Estate Investment. As with most industries, the relationships you build have a large impact on your success. Relationships are also all about “Fit” and “Transparency”. You are only as good as what others say about you, and to do something successfully for the long term, I believe you need to be open in how you conduct your business relationships. We also all have different personality types, and are not on this earth long enough to spend time and invest time in those we don’t have a fit with. Working with someone on Real Estate Investment should be an exciting time. You need to have confidence in those you work with and it helps when you enjoy sitting down to have a drink or a bite together. I am quite selective on the fit of the people I do business with, and I expect the same who look to partner with me. I’m also quite open that if someone does not sense a fit with me, my team, and what we provide, I would be happy to refer them to another investor or colleague that could help them move forward.

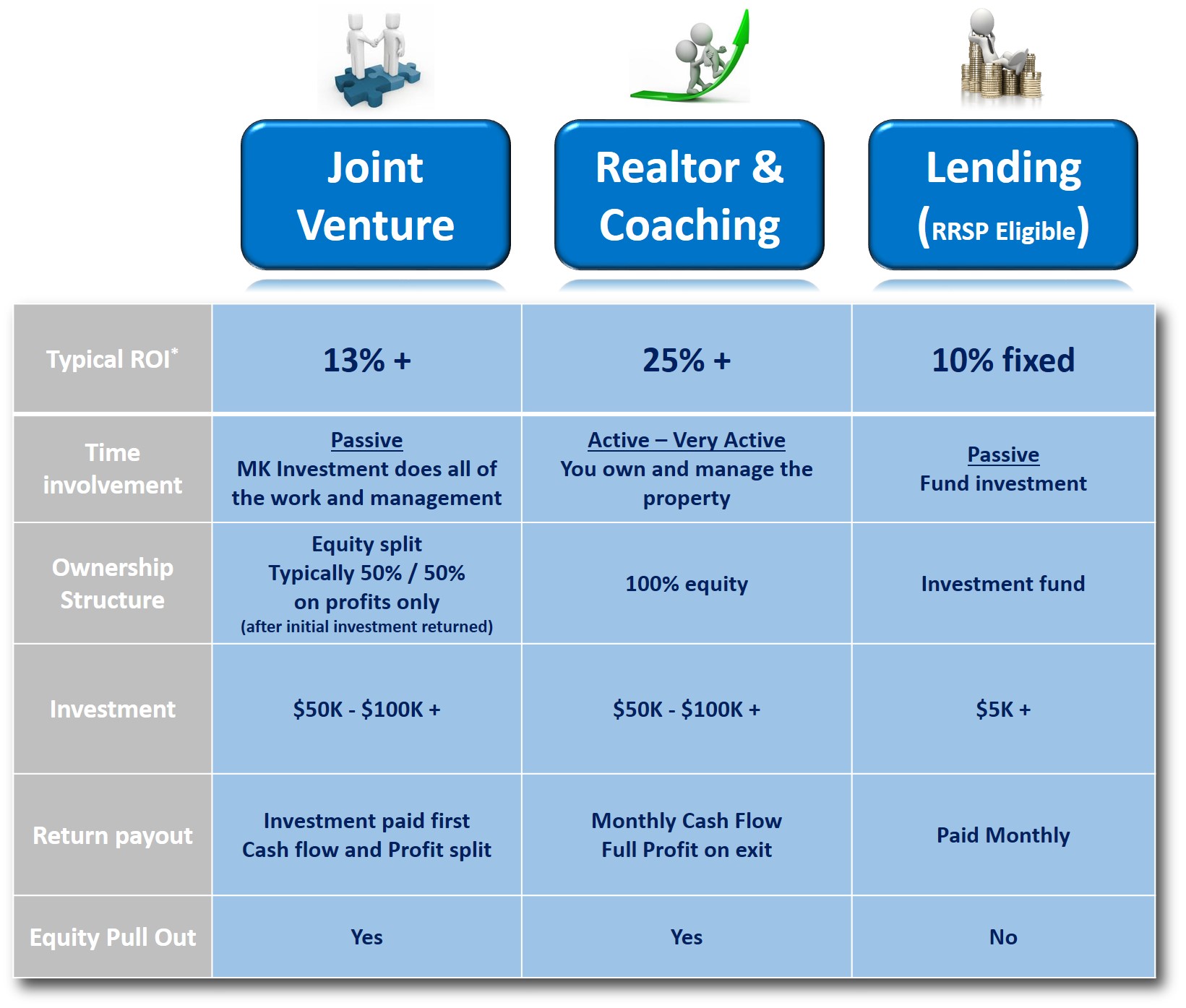

As our slogan says, we help our clients and partners Build Wealth so they can Live Life on their own terms. Essentially we help those that understand real estate is a solid investment strategy and are not satisfied with the single digit returns they are getting from more traditional investment vehicles (such as stocks and mutual funds). In terms of Products & Services, I have structured what we offer to be able to help anyone that has an interest in Real estate investment. Whether they want to be hands off, fully involved, or simply treat real estate like a stock investment. Below are the 3 main Pillars in how we work with our clients:

Joint Venture Partnerships: In a joint venture structure, you treat the home purchase like you would a stock or mutual fund purchase. You the investor would invest the Down payment, closing costs and renovation funds needed. We then take care of everything to do with finding the property, managing the property and making sure it is run as efficiently as possible, while keeping you completely up to date on your investment. We only get paid once your complete investment is returned to you, and then divide profits based on equity split (typically 50%/50%). Assuming historical market appreciation of 5%, investors can expect a healthy double digit return of +12% or higher annually on their investment with a Joint Venture partnership.

Realtor & Investment Coaching: With a coaching scenario, we will guide you through the purchase of your investment property and provide you all the resources and contacts you need to go out and actively manage the property yourself. We would become your realtor/coach for the investment, hence you would not physically pay us for our services as they are covered by property sellers when you purchase a property. There is much more profit to be made on your investment assuming you would like to have hands-on management with operating the property. This is not a passive approach to investing, you should expect to spend a lot of time managing your asset (specially on your first purchase). However this approach does provide the fastest wealth building potential. Assuming historical market appreciation investors can expect to make a return of +20% to +30% annually on their money, however should take into account the return needed for the time they spend as well.

Lending: You become the bank! In this scenario, you lend out your money in much the same way a bank does when they provide a mortgage. Your investment is well protected given the total loan would never exceed 85% of the value of the property, meaning if there was a foreclosure situation, there is plenty of equity in the property to secure your investment. To secure your investment further, we do not advise to invest all of your money in one mortgage, hence we invest in a pool of mortgages through Paramount Equity Financial Corporation. This option allows registered funds such as RRSP’s and TFSA’s that could be used and provides a +10% fixed rate of return, paid out monthly.

Visit us at www.mkproperties.ca and our page MK Investment Group on facebook or LinkedIn to learn more about how we invest in real estate to profit in both an increasing or decreasing housing market. Or contact us if you would like to learn how we are providing double digit returns for our partner’s and clients year over year.

Until Next Time,

Build Wealth-Live Life.

If you live in the GTA, we have started the Vaughan Real Estate Investors Club – a meet up run by investors for investors. If you are just starting out, or a seasoned pro, come out to Learn and Network with others like you. Our next meetup will be May 24, 2017 at 7:00pm where we will cover off Corporations and tax planning for real estate investing. Click the link above to go to our site on meetup.com or visit our page on facebook. We look forward to connecting in person.

If you live in the GTA, we have started the Vaughan Real Estate Investors Club – a meet up run by investors for investors. If you are just starting out, or a seasoned pro, come out to Learn and Network with others like you. Our next meetup will be May 24, 2017 at 7:00pm where we will cover off Corporations and tax planning for real estate investing. Click the link above to go to our site on meetup.com or visit our page on facebook. We look forward to connecting in person.

Martin Kuev is a full time Real Estate Investor, Realtor and Investment Coach. He has worked for some of the most respected and well-known global organizations including Coca-Cola, Kraft and Nestle. With a multi-million-dollar real estate portfolio and team he built over the past decade, he left the corporate world to have the flexibility to spend time with his family, continue with his real estate investments and help others build their long-term wealth.