This past February has been amongst the warmest on record for southern Ontario. With 3 young children, we try to take in as much of the warm weather as we can get. The attached picture is our family enjoying a nice stroll in our neighborhood. Regardless of your Investments, or a job/career that you

This past February has been amongst the warmest on record for southern Ontario. With 3 young children, we try to take in as much of the warm weather as we can get. The attached picture is our family enjoying a nice stroll in our neighborhood. Regardless of your Investments, or a job/career that you  have, we hope those are simply tools to allow you to live the life you want rather than thinking and breathing work day-in day-out. Although we are passionate about real estate, our Relationships, Friends and Family are how we want to spend our time. Real estate is simply the best investment option we have found (and we’ve researched pretty much all of them) that allows us to live life on our own terms.

have, we hope those are simply tools to allow you to live the life you want rather than thinking and breathing work day-in day-out. Although we are passionate about real estate, our Relationships, Friends and Family are how we want to spend our time. Real estate is simply the best investment option we have found (and we’ve researched pretty much all of them) that allows us to live life on our own terms.

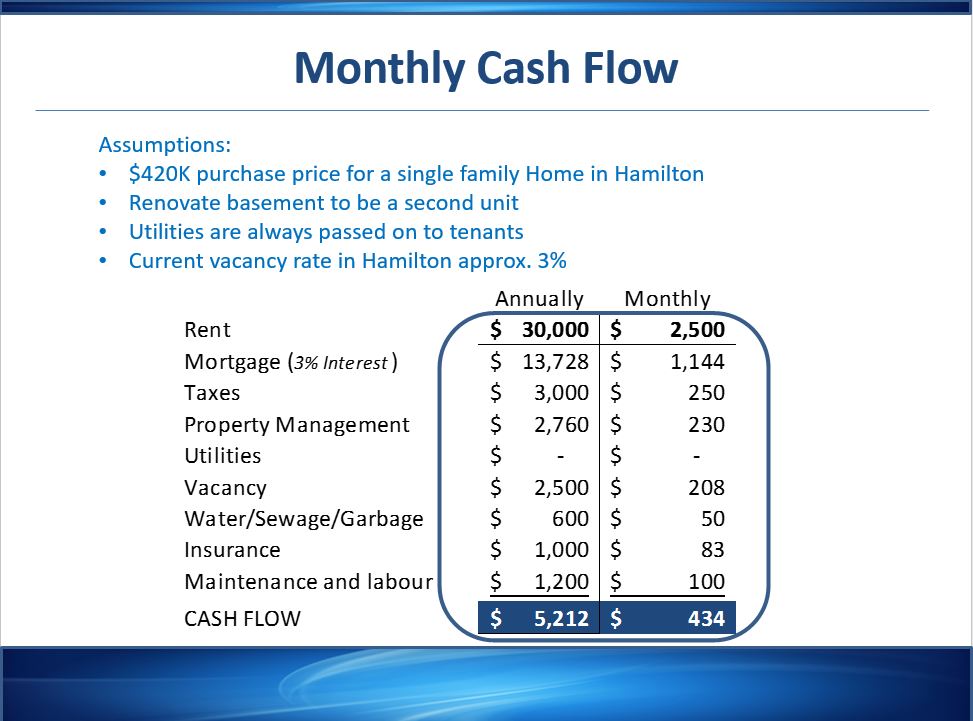

For this post, we are going to outline what makes a good real estate deal. First and foremost, the numbers need to work out. For us this means having an investment that is not based on speculation or consumer confidence, but rather being able to profit month-in, month out with information that is known prior to purchase. Our criteria when purchasing a single-family home for example is that after all expenses are paid, we look to have $300-$500 monthly left over after ALL expenses on the property are paid each month. This cash-flow is how we mitigate risk and protects us should interest rates rise, and/or something unexpected comes up for the property (ie: repairs, etc.). Check out our previous Blog “Do Your Investments Profit even when the market corrects itself?” where go through how a property should profit regardless of the home value. The great thing about cash flow calculations is that we would know all those numbers prior to purchasing a property, and would not even make an offer if the financials did not work. See Below for how typical monthly numbers would look like for homes we are currently purchasing in today’s market.

[button link=”https://www.dropbox.com/sh/plroghinhrpa0vj/AAD2CI2dJKq5MJ593gHqt3x3a?dl=0″ size=”small, medium, large” target=”_blank or _self” icon=”cog” color=”white, yellow, orange, red, blue, green, gray, black, alternative-1, alternative-2, alternative-3″ lightbox=”true or false”]Click Here to Download our Free Property Analysis Tool[/button]

Financials are only half the equation however. Cash flow mitigates your risk and allows you to profit even if the home value does not increase. However, we also need to choose properties that are located in areas that are poised for future growth. It’s like Wayne Gretzky used to say “I skate to where the puck is going to be, not where it has been”. We look at Macro and Micro Economic factors and trends that help us evaluate the area of a particular home.

- Macro: Area/Region factors. In looking at the overall area, look for what will drive population growth (demand) in the coming years. A key indicator would be to look at city official plans to see the amount of money that is being spent on transportation and industry (this is a good indicator that they are planning for growth over the next 10-20 years). A good hint is to follow significant spending in transportation (ie: GO Train, subway, Transit)

- Micro: City/Neighborhood. This is more about the tenants that will be occupying your property. Assuming the Macro trends look good, we identify properties that will provide a good tenant profile. Schools, income, vacancy rates and education, are all good indicators of the type of tenant that you would typically have in a given area.

Ultimately, when you have a property that you know is going to provide you cash flow each month (regardless of the value of the home), and you are in a location that has economic factors that point to sustained long term growth, this to us is a sound investment strategy. You mitigate your risk with the surplus cash flow (you will profit even if homes value remains flat). However, you set yourself up to build long term wealth even with average price appreciation. Typically our investments provide a return greater than +20% annually with average home appreciation of only +5%.

Visit us at www.mkproperties.ca and our page MK Investment Group on facebook or LinkedIn to learn more about how we invest in real estate to profit in both an increasing or decreasing housing market. Or contact us if you would like to learn how we are providing double digit returns for our partner’s and clients year over year.

Until Next Time,

Build Wealth-Live Life.

If you live in the GTA, we have started the Vaughan Real Estate Investors Club – a meet up run by investors for investors. If you are just starting out, or a seasoned pro, come out to Learn and Network with others like you. Click the link above to go to our site on meetup.com or visit our page on facebook. We look forward to connecting in person.

Martin Kuev is a full time Real Estate Investor, Realtor and Investment Coach. He has worked for some of the most respected and well-known global organizations including Coca-Cola, Kraft and Nestle. With a multi-million-dollar real estate portfolio and team he built over the past decade, he left the corporate world to have the flexibility to spend time with his family, continue with his real estate investments and help others build their long-term wealth.